IMPACTASSETS 50™

An Annual Showcase of Impact Investment Fund Managers

ImpactAssets 50

An Annual Showcase of Impact Investment Fund Managers

City Light Capital

Climate Change

Climate Change Education

Education Health and Wellbeing

Health and WellbeingFirm Overview

City Light is a Venture Capital firm that invests early in impactful companies. They partner with experienced teams building category-defining solutions in the areas of education, safety and care, and the environment - where more revenue equals better lives at scale, every time. As one of the earliest and most successful impact investing firms, City Light has a track record of identifying and scaling impact in ways that build better companies.

Years of Operation: 10 years or more

% of Capital from Top 3 Investors: Less than 25%

We invest in companies where more revenue equals better lives at scale, every time.

We invest in companies where the core product or service generates positive social or environmental impact. These products and services typically include some sort of data component that allow us and the company to track impact over time - and to adjust the product to optimize impact early on.

City Light has proprietary data and systems built to give us an edge in the market. We built "The Machine", which allows us to see more than 50,000 deals every quarter and collect data on thousands more. We also manage a seed portfolio of more than 50 companies, all of which report to us on financial, operational, and impact KPIs - creating a unique data set of early-stage impact companies.

Investment Example

OhmConnect is a residential demand response provider focused on reducing carbon emissions generated through residential electricity use. When the energy grid is at peak demand, OhmConnect pays consumers to turn off their internet-connected devices at home to save energy. As a result, utilities do not have to turn on harmful peaker plants, which emit more carbon. OhmConnect and its users are only paid when the energy is saved, thus creating a positive impact feedback loop.

Leadership and Team

|

Josh Cohen – Partner More Info

When considering how he wanted to be remembered, Josh turned to impact investing before it had a name, combining his experience as a venture capitalist, technology company executive, and family office CIO with his values. Thus, the idea for City Light was born: partnering with experienced entrepreneurs using technology to generate significant financial returns while having a measurable social impact. Prior to founding City Light, Josh led direct investments for a Greenwich CT-based family office, worked in venture capital for a family office based in St. Louis, was a Partner in a private debt fund, and was the Director of Business Development for Mobility Electronics (NASDAQ: IGOI). He began his career as an investment banker in the technology group of Deutsche Banc Alex Brown in San Francisco. |

|

Jeff Rinehart – Partner More Info

That journey began at Capital One (NYSE: COF), where he spent over a decade leading data science and analytics teams across the organization. In his last role, Jeff was VP of Marketing Strategy for US Card where he oversaw a high nine-figure marketing budget across all online and offline marketing channels. Ultimately the need to have a greater impact on the world around him was the driving force for Jeff leaving Capital One to join an EdTech startup on a mission to change higher education. Jeff joined 2U (Nasdaq: TWOU) as their CMO in early 2011, overseeing all aspects of marketing for their University partners. Jeff was part of the core leadership team that grew 2U from a venture-backed startup, through a successful public offering on the NASDAQ. |

|

Tom Groos – Partner More Info

Now at City Light, Tom leverages his extensive operating experience to help entrepreneurial teams tackling some of our toughest social and environmental challenges. Tom sits on the Board of Directors for Shotspotter-SST (NASDAQ:SSTI), Omnidian, VGrid, and Senet, and is a Board Observer to Xage and Sunfolding. |

Financial Performance

Impact Performance

|

Percentage of Total Assets Under

Management that are Impact Investments: |

100%

|

The product MUST generate the positive impact in and of itself. In other words, the target outcome of the product should be the desired impact, and that outcome should be trackable through the product.

Companies fill out a survey allowing them to self-identify the demographic makeup of the management team.

Impact Tracking and Monitoring

Learn More

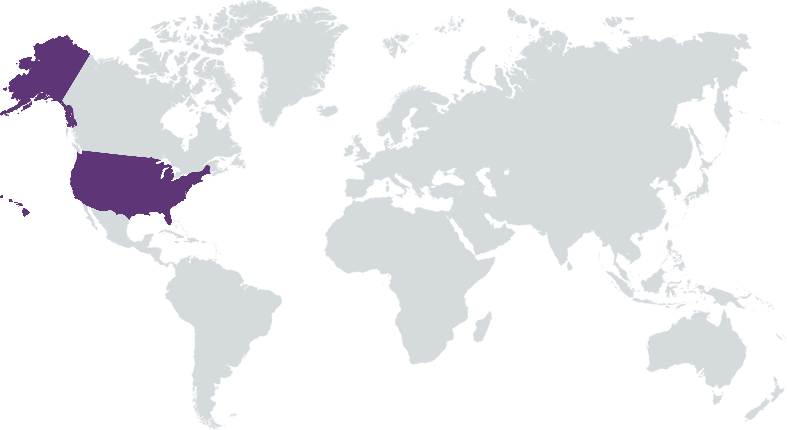

335 Madison Ave, Floor 16, New York, NY 10017 USA

Apply for the IA 50 2022

The application period to become an ImpactAssets 50 2022 Fund Manager will open in September 2021!

To stay informed on the application process, sign up here.