IMPACTASSETS 50™

An Annual Showcase of Impact Investment Fund Managers

ImpactAssets 50

An Annual Showcase of Impact Investment Fund Managers

Grassroots Capital

Management Corp, PBC

Community Development

Community Development Financial and Economic Inclusion

Financial and Economic Inclusion Food Systems and Agriculture

Food Systems and Agriculture Microfinance and Low-income Financial Services

Microfinance and Low-income Financial ServicesFirm Overview

Years of Operation: 5 – 9 years

% of Capital from Top 3 Investors: 50% – 99%

Investment Example

Leadership and Team

|

Paul DiLeo – Founder and Managing Partner More Info

Paul DiLeo has pioneered the mobilization of private capital for microfinance, helping shape the sector as an investable opportunity. With over two decades of experience in development finance and 15 years' experience in the microfinance sector, he has cultivated a wealth of knowledge in the industry and is respected as a thought leader. Paul launched and managed the Gray Ghost Microfinance Fund, the first US private, for-profit microfinance fund established to demonstrate the viability of microfinance investment. He was also instrumental in setting up a U.S. government-backed Russian investment fund, made equity investments in leading microfinance institutions in India and Bangladesh, and worked extensively in advising and evaluating microfinance institutions and small business banks around the world. Paul started his career in international finance with the U.S. Treasury and Federal Reserve Bank of New York. |

|

S Viswanatha Prasad – Senior Advisor More Info

Prasad is the founder of Caspian Advisers and co-founder of the Bellwether Microfinance Fund. Prasad has over 20 years of experience in the mainstream financial sector, of which the last 8 years have been spent in microfinance. Prior to founding Caspian and launching Bellwether, Prasad held the positions of CFO, COO and eventually CEO of Bhartiya SamruddhiFinance Limited, the flagship company in the BASIX group, one of the largest microfinance networks in India. BASIX was the first microfinance institution in India to raise external equity, as well as the first in Asia to securitize its microfinance portfolio. |

|

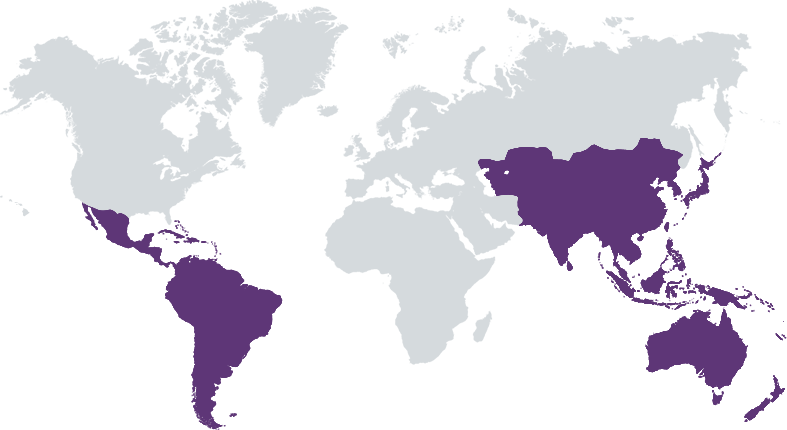

Louise Moretto – Managing Director of Investments More Info

Louise has over 20 years of experience in banking, social investing, and international development. She has worked globally in more than 20 countries to secure funding for microfinance institutions and social enterprises and to deliver capital markets and risk management capacity building. At GCM, Louise serves as the Managing Director of Investments. |

|

Anna Kanze – Investment and Social Performance Manager More Info

Anna Kanze leads Grassroots’ investment monitoring and reporting, industry research, and social performance measurement functions, in collaboration with colleagues based in India, Southeast Asia and Latin America. In this capacity, she performs due diligence on potential partners, evaluates debt and equity investment proposals, and has been active in the co-creation of regional funds. Since joining Grassroots in 2008, Anna has been instrumental in developing and executing Grassroots’ investment management processes, including the valuation of equity investments. |

Financial Performance

Impact Performance

|

Percentage of Total Assets Under

Management that are Impact Investments: |

100%

|

Impact Tracking and Monitoring

Learn More

Plainfield, MA 01070

USA

Apply for the IA 50 2022

The application period to become an ImpactAssets 50 2022 Fund Manager will open in September 2021!

To stay informed on the application process, sign up here.